Contractors must serve valid payment claims to apply for adjudication under security of payment legislation. This article runs through some key issues when preparing payment claims to help ensure that you will be able to apply for adjudication later.

Background

Preparing a payment claim during the construction phase is often time consuming and difficult. You need to ensure that your payment claim contains enough information to be valid, without wasting valuable time.

The Supreme Court of Queensland decision in KDV Sport Pty Ltd v Muggeridge Constructions Pty Ltd (2019) QSC 178 provides insight in this respect. Specifically, the decision provides helpful guidance on what is needed to “identify the construction work” in a payment claim – one of the key requirements of a payment claim under the Building Industry Fairness (Security of Payment) Act 2017 (BIFA).

Requirements under BIFA

Section 68 of BIFA describes a payment claim as “a written document that:

- identifies the construction work or related goods and services to which the progress payment relates; and

- states the amount (the “claimed amount” ) of the progress payment that the claimant claims is payable by the respondent; and

- requests payment of the claimed amount; and

- includes the other information prescribed by regulation.

In this article, we ask: What must a contractor include in a payment claim to ensure that it “identifies the construction work”?

Muggeridge’s Payment Claim

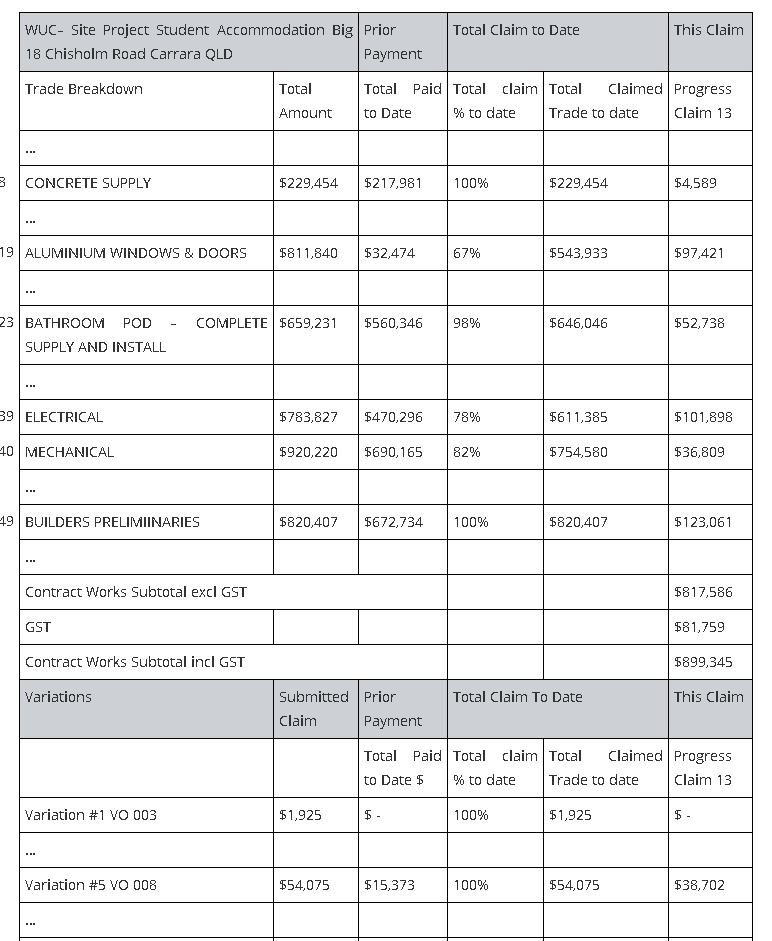

Muggeridge Constructions Pty Ltd served a payment claim for $2,365,432. The payment claim included:

- the percentage of work completed;

- a reference to a “Trade Breakdown Schedule” describing the categories of work completed; and

- claims for variations that Muggeridge had not submitted or described.

An excerpt from Muggeridge’s claim is below:

The Supreme Court’s decision

KDV Sport Pty Ltd (KDV) certified $0 in its payment schedule.

Muggeridge applied for adjudication of the payment claim under BIFA. The adjudicator awarded Muggeridge $802,198.59.

KDV applied to the Supreme Court to set the decision aside, asserting that the payment claim was invalid because it did not sufficiently identify the construction work to which it related.

Muggeridge submitted that the Trade Breakdown Schedule and KDV’s background knowledge enabled KDV to identify the completed construction work, and therefore that the payment claim was valid.

The Supreme Court sided with KDV, deciding that the payment claim was not comprehensible to a reasonable principal, mainly because:

- The payment claim did not contain enough information for parties with background knowledge of the Trade Breakdown Schedule to identify the actual work, understand the claim and respond.

- A mere reference to a completed percentage of a category of work does not identify the actual work that the claim relates to sufficiently.

- The unhelpfulness of the percentages was compounded by the principal’s (and the Court’s) inability to reconcile various amounts of work claimed and the cost thereof.

- Muggeridge did not submit the variations by the date of the payment claim, support the variations with further information, or describe the work that the variations related to.

The Supreme Court determined that because of the above, the payment claim did not “identify the construction work” and hence the payment claim was defective, resulting in the adjudication decision being set aside.

Lessons learned

Whilst certainly a cautionary tale, the decision here should not be read as a warning to do away with all percentage-of-works based claims. The claim here was truly subject to “death by a thousand cuts” and the validity of every claim will turn on its own facts. That being said, and whilst there is no prescriptive form of a payment claim, generally:

- The contractor should describe the actual work completed and how it calculated the claim.

- If possible, the contractor should support the claim with evidence of the amount due. This evidence may include breakdowns of variation costs, quotes, third party invoices and photographs.

- If a claim is submitted using percentages or fractions of work, careful consideration should be given to the question: “What makes the 20% completed this month different from the 20% claimed last month and how does the person assessing the claim know this?”

- The contractor should submit variations with or before the payment claim. The payment claim should describe the variation work or annex the supporting information.

- The payment claim should state the claimed amount and request payment of the claimed amount.

- There is no “other information prescribed by regulation” in Queensland currently. The position is different in other states. For instance, payment claims in New South Wales must, in certain prescribed circumstances, attach supporting statements.

The court recognises that a payment claim can be meaningless to an uninformed reader, but comprehensible to parties with background knowledge and understanding. However, that does not mean you can assume that the other party is required to unravel your assertions if it is not clear what work you are claiming – ask yourself “if I hadn’t completed the work, would I know what I was talking about?”

Further considerations

When drafting payment claims, contractors should also consider:

- The requirements of the specific contract.

- Conduct and directions regarding payment claims given when the contract was entered or during the construction phase.

- Whether the contractor has a valid reference date.

- Whether the payment claim includes any amounts previously dismissed by an adjudicator.

- Specific requirements of legislation, such as supporting statements in NSW.

- Time limits under the contract and under state legislation.

If you’re preparing a payment claim or have received one and aren’t sure whether it meets the standard required, don’t hesitate to get in touch and we’d be happy to talk through it with you.