Big news for the Queensland construction industry:

New requirements for project trust accounts for eligible building contracts in Queensland commenced for a limited number of projects in early 2021.

From 1 January 2022, project trusts will apply to eligible contracts in QLD over $10 million, including where the contracting party is a private entity.

This marks the largest expansion of the application of project trusts to date and will impose significant obligations on a broad range of construction industry participants.

Project trust accounts are regulated under the Building Industry Fairness (Security of Payment) Act 2017 (Qld) (the BIF Act). The regime includes:

- Replacement of Project Bank Accounts (PBAs) with Project Trust Accounts (PTAs);

- Retention Trust Accounts (RTA); and

- new oversight powers granted to the Queensland Building and Construction Commission (QBCC).

The QBCC has stated that the reforms are designed to:

streamline existing project bank accounts into a new project trust account framework to further protect payments to contractors, as well as reducing the administrative burden for head contracts.

The new project trust account regime commenced on 1 March 2021 and initially applied to eligible contracts where the contracting party is the State Government with a contract price between $1 million and $10 million.

Since 1 July 2021, the new project trust account regime has applied to:

- all eligible State Government contracts with a contract price over $1 million; and

- eligible contracts where the contracting party is a hospital or health service and the contract price is over $1 million.

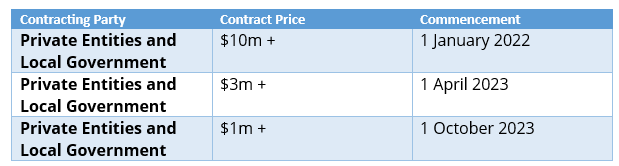

Further implementation of the regime will occur for eligible contracts in stages:

It is critical that all parties affected by the legislation properly apply the BIF Act to their circumstances.

To help you and your business understand the requirements and risks, we discuss the operation of the PTA provisions across a 3 part series of articles:

- Does Queensland’s Project Trust Account legislation apply to you? (this article);

- Caught by the Project Trust Account legislation? What now? (coming soon);

- Huge fines or jail time for Project Trust Account Breaches (coming soon).

Project Trust Accounts (PTAs)

The best way to understand project trust accounts is to run through a typical example.

Let’s take the viewpoint of a head contractor.

The head contractor is engaged by a principal under a head contract. The principal will be required to pay any monies payable to the head contractor directly into a PTA, rather than to the head contractor.

All payments to subcontractors must be paid directly from the PTA.

The head contractor needs to establish one PTA, for each eligible contract for project trust work.

There are strict requirements in relation to the timing for opening the PTA, how the PTA needs to be opened and the financial institutions at which a PTA may be established. We will cover this in more detail in a future article.

The PTA regime does not affect contractual entitlements to payment, or rights under the BIF Act in relation to payment.

Is the Head Contractor Required to Establish a PTA?

To determine whether the head contractor must establish a project trust account, they must ask themselves whether the contract is an ‘eligible contract’ for ‘project trust work’.

Eligible Contract

From 1 January 2022, a contract will be eligible for a project trust if:

- the contracting party is the State, a State Authority, a local government, an individual, a private entity or a hospital and health service; and

- more than 50% of the contract price is for project trust work; and

- the contract price is –

- if the contracting party is the State or a hospital and health service – $1 million or more; or

- otherwise – $10 million or more.

Refer to the table above in relation to the extension of the new requirements to other contracts.

Project Trust Work

Project trust work is broadly defined and includes:

- the erection or construction of a building;

- the renovation, alteration, extension, improvement or repair of a building;

- provision of lighting, heating, ventilation, air conditioning, water supply, sewerage or drainage in connection with a building;

- any site work related to the kind of work described above;

- preparation of plans or specifications for the performance of other project trust work;

- earthmoving and excavating associated with a building;

- installation of prefabricated components of a building;

- mechanical services work that is associated with a building.

The above is not the entire list of work which qualifies as project trust work.

Project trust work does not include:

- the construction, maintenance or repair of a busway, road or railway;

- the construction, maintenance or repair of a tunnel for a busway, road or railway;

- an authorised activity for a resource authority (defined under the relevant Resources Act under which the resource authority is granted).

When is a Project Trust Account not required?

There are certain exempted contracts which do not require PTAs. These include:

- contracts where the only parties to the contract are the State and a state authority;

- contracts where the only project trust work to be carried out under the contract is:

- residential construction work for less than 3 living units;

- maintenance work;

- advisory or design work carried out by an architect, engineer or designer;

- contracts where there is less than 90 days between when the trust would be required and the date for practical completion; and

- any subcontract other than subcontracts with related entities – ie. where the subcontractor is a related entity of the head contractor.

Retention Trust Accounts (RTAs)

An RTA for a retention amounts withheld from payment under a contract must be established if:

- the withholding contract is either a head contract or a first tier subcontract for a head contract; and

- the contracting party withholds retention in the form of cash; and

- a project trust is required for the head contract.

All retention amounts must be held in the RTA until they are due to be released in accordance with the relevant contract.

Next steps

So are you caught by the PTA legislation?

Watch this space, as we’ll be setting out in more detail the tips and traps of PTAs soon.