By Michael Batch

The Queensland Government is again attempting to fix the cash flow and insolvency issues facing the construction industry.

The question is whether the latest round of legislation will be the ‘magic pill’ to resolve these issues. Will it meet the Government’s promise to usher in a “new age of fairness” in the industry?

The legislation is called the Building Industry Fairness Security of Payment Bill 2017 (the Bill). The Bill has been referred to the relevant parliamentary committee who will consider submissions on the Bill.

The Bill:

• amends and/ or incorporates:

• the Building and Construction Industry Payments Act 2004 (BCIPA);

• the Subcontractors Charges Act 1974 (Qld) (Subcontractors’ Charges);

• the Queensland Building and Construction Commission Act (QBCC Act); and

• introduces project bank accounts (PBAs).

So what do these proposed changes mean for you?

BCIPA

From a cash flow and fairness perspective, some of the BICPA changes are good. However, some are not so good.

My comments are set out below:

• The removal of the s.20A second chance notice is good. It means that an amount claimed in a BCIPA payment claim crystallises as a debt (enforceable through the courts or adjudication) if the respondent fails to serve a payment schedule within the prescribed time. It is particularly welcome given that some respondents were ‘gaming’ the s.20A process in order to further delay payment.

• Removing the need for claimants to endorse their BCIPA claims with the words “this is a Payment Claim under the Building and Construction Industry Payments Act 2004 (Qld)” is peculiar. Much like it has in NSW, it may result in confusion and unfair results, particularly where the recipient of the un-endorsed payment claim is not familiar with the consequences of not responding with a payment schedule within the prescribed timeframe. Some might argue that ignorance is no excuse, but giving a respondent no clue whatsoever about the consequences of not responding within the prescribed timeframe strikes me as far too claimant friendly.

• The benefits of increasing the available time to submit an adjudication application following receipt of a payment schedule from 10 business days to 30 business days could be outweighed by the downsides. Although it will offer more time to prepare claims, it will also potentially result in increasing the claimant’s costs for lawyers, consultants, experts and internal resources as “Parkinson’s law” kicks in – i.e work expanding to fill the time available for its completion. Some might argue that claimants don’t have to use the 30 days available, and could continue to lodge their adjudication applications within 10 business days, but that outcome is likely to be rare.

• The legislation creates a statutory reference date upon termination. This amendment arises because the currently accepted law is that reference dates do not accrue after termination. Is this a good amendment? If the contract is terminated, the parties should arguably be fighting over final rights, not supposedly “interim” rights for a progress payment. However, on a positive note, the amendment may help to overcome the consequence of respondents terminating contracts for convenience simply to avoid a claim being made under the BCIPA.

• The revival of the framework preventing a respondent raising new reasons in an adjudication response not raised in a payment schedule is a good amendment. It will force earlier communication between the parties about why a respondent has scheduled an amount less than the claimed amount.

SUBCONTRACTORS’ CHARGES ACT

There are no amendments to the fundamental operation of the SCA.

The most notable amendment shortens the time frame for a party to respond to a notice of claim from 14 days to 5 business days. This seems a sensible amendment. Although making failure to comply with this obligation an offence is quite a radical shift.

QBCC ACT

The Bill amends the QBCC Act in the following way:

• increases the QBCC’s power to require a building company to provide its financial records;

• revives the obligation for building companies to comply with mandatory financial reporting;

• seeks to regulate corporate phoenixing by expanding the concept of “excluded individuals” to a person who is a director or an influential person of the company within two years of it going into liquidation; and

• provides that certain ‘prohibited conditions’ (not yet defined) will be declared void and unenforceable if incorporated into any building contract.

PROJECT BANK ACCOUNTS (PBAs)

The most controversial aspect of the Bill is the introduction of Project Bank Accounts (PBAs).

Section 7 of the Bill describes its purpose as being “to ensure that money to be paid to particular subcontractors is held in a way that protects the interests of the subcontractors.”

Based on the Government’s announcement, Project Bank Accounts will be implemented in 2 stages:

• Stage 1: on and from 1 January 2018, PBAs will required on Government building and construction projects between $1 million and $10 million incl GST; and

• Stage 2: on and from 1 January 2019, PBAs will be required on all building and construction projects in excess of $1 million incl GST (subject to certain exceptions such as residential construction work).

“Contract price” means:

• The amount the head contractor is entitled to be paid under the contract; or

• If the amount cannot be accurately calculated, the reasonable estimate of the amount the head contractor is entitled to be paid under the contract.

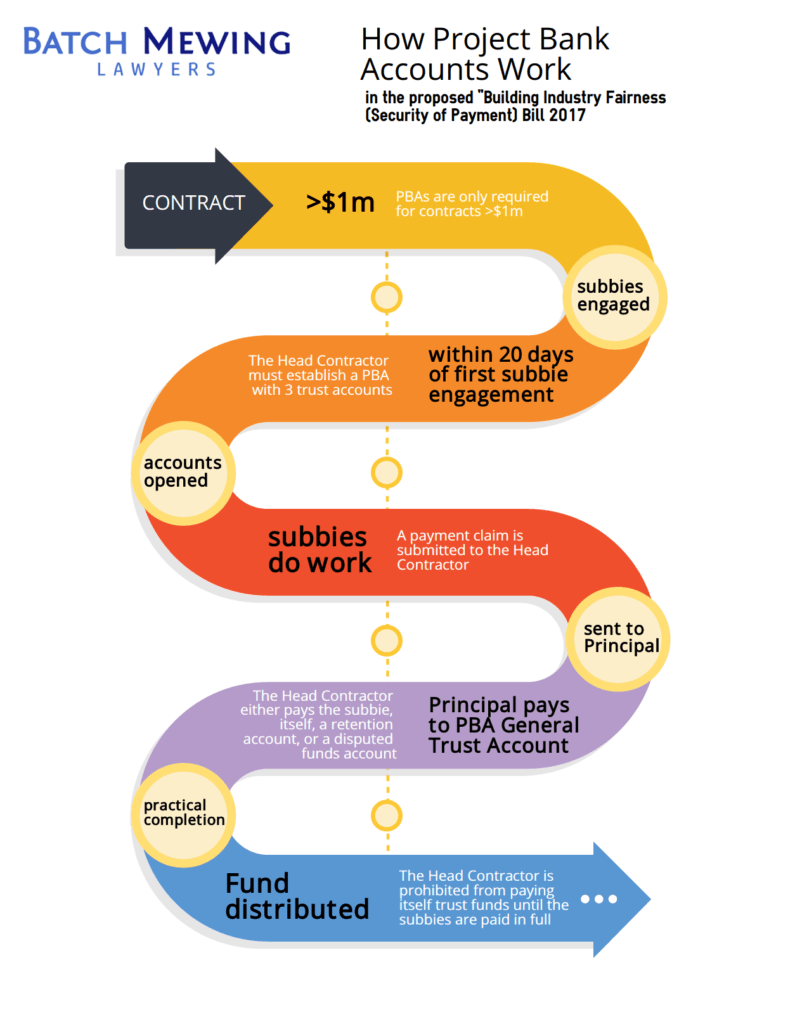

But how do PBAs operate?

Let’s say a principal engages a head contractor for a contract price of $6M.

Generally, within 20 business days of entering into the first subcontract for the project, the head contractor must establish a Project Bank Account (PBA).

The PBA must include the following trust accounts:

• a general trust account;

• a retention account; and

• a disputed funds account.

The head contractor will be the trustee of each account with both the head contractor and subcontractors as beneficiaries.

How will the PBA trusts impact the submission and payment of payment claims?

In the usual way, a payment claim will be submitted by a subcontractor to the head contractor on and from the reference date (usually monthly). Let’s say the claimed amount is $600,000.00.

The head contractor will submit their payment claim to the principal, and their claim will naturally incorporate their entitlement to be paid for works carried out by their subcontractors.

But from this point on, things change.

Instead of the principal paying monies directly to the head contractor’s account, they will pay their assessment of the claim into the general account of the PBA, which will be controlled by the head contractor as trustee.

The head contractor (as trustee) will hold the PBA monies on trust, and distribute it by:

• paying the subcontractor beneficiary the amount entitled under the subcontract;

• paying into the retention account the subcontractor’s retention entitlement;.

• paying the head contractor beneficiary the amount entitled under the head contractor for which it is not liable to pay the subcontractor; and

• paying into the disputed funds account an amount the subject of a payment dispute, that is, the difference between:

• the head contractor’s scheduled amount (i.e the amount they proposed to pay); and

• the ‘instructed amount’ being the amount the head contractor actually instructed be paid to the subcontractor in respect of that payment claim.

The head contractor must not pay itself until the subcontractor’s amount is paid in full.

Risk of Shortfall

Section 30 requires the head contractor to cover the shortfall between:

• the amount available in a trust account; and

• the amount to be paid from a trust account.

The shortfall must be paid into the trust account.

Once paid in, it must then be paid out in accordance with Section 31 of the Act.

The “amount available in a trust account” is self explanatory. It generally represents the amount paid in by the principal and the shortfall amount transferred to that account by the head contractor as explained above.

The “amount to be paid” is not defined.

Most commonly, the “amount to be paid” will be the head contractor’s scheduled amount. Although, based on section 32(3) of the Bill, it may also be the amount determined under a BCIPA determination or the amount a court orders that the head contractor pay to a subcontractor.

Insufficient amounts available

But what if there are insufficient funds in the trust account?

In that case, the Bill requires the head contractor must pay their subcontractors on a proportionate basis.

The example given in the Bill is as follows:

If one subcontractor beneficiary is due to be paid $50,000 and another subcontractor beneficiary is due to be paid $30,000, but only $40,000 is available, the beneficiaries are to be paid $25,000 and $15,000 respectively.

As you would expect, the interim proportionate payment to subcontractors does not relieve the head contractor of paying each of the subcontractors the full amounts to be paid.

FINAL COMMENT

Time will tell whether the Bill achieves what it has set out to achieve.

We will first need to see whether the final form changes substantially before the legislation is formally enacted.

In summary, my current views on the current wording are:

• It is unlikely to achieve the lofty heights set by the government of ensuring subcontractors to get paid ‘on time, every time’.

• Some amendments will help the industry’s cash flow (removal of the s.20A notice, statutory reference dates upon termination, no ‘new’ reasons in adjudication responses, shortened time for principals to respond to notice of charge under the SCA).

• Some amendments are of marginal benefit and could result in the unwanted outcome of higher costs in the adjudication process (increasing the time for lodging an adjudication application from 10 to 30 business days).

• The downsides to the PBA amendments far outweigh any perceived upside. The big loser will be the head contractors. The extra administrative burden and financial pressure placed on head contractors already facing a tight market could result in the PBA amendments having the opposite effect to that intended.

What about you? Do you agree? We welcome your feedback and comments.