Choose the right combination of claim recovery options

“Your best option will vary from claim to claim. One size does not fit all.”

You will recall as part of this series that we have looked at the following topics:

1. Step 1: Get to know your claim

2. Step 2: Anticipate your client’s response

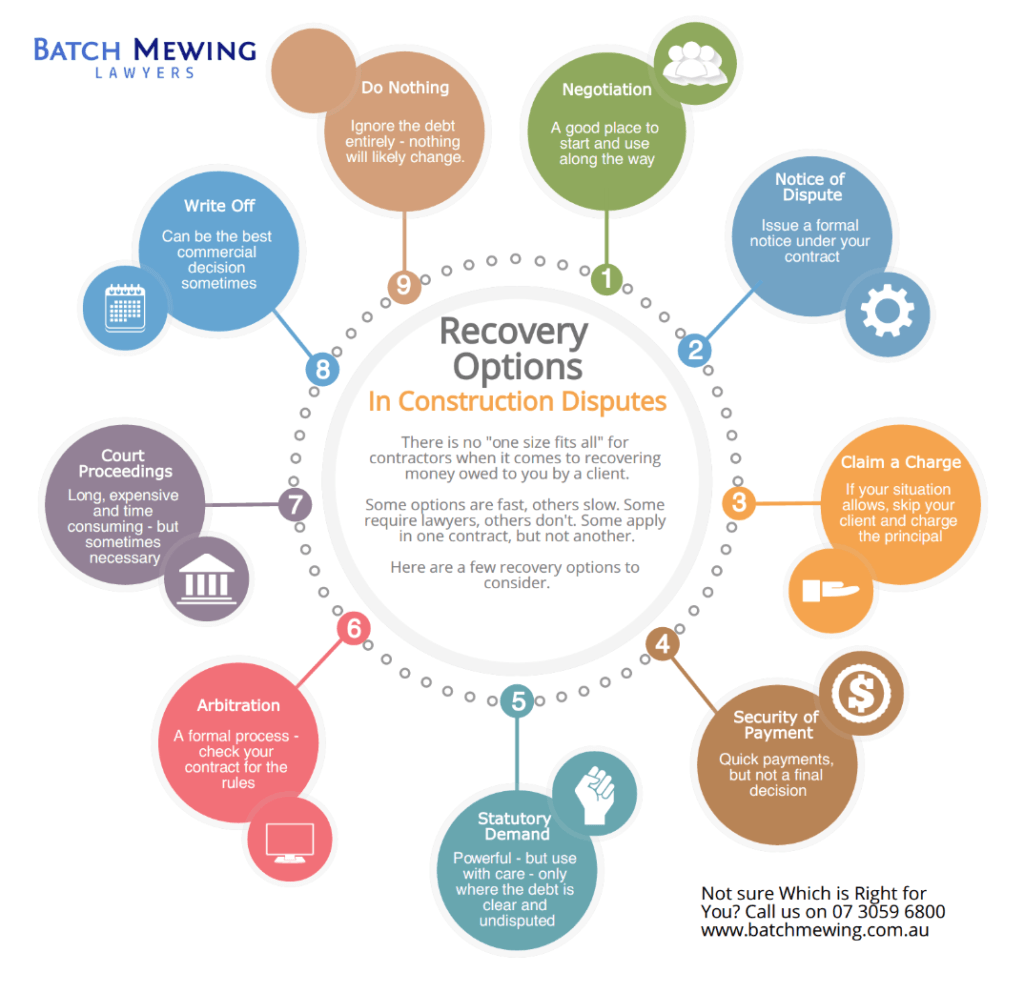

Now as step 3, we will consider the available recovery options. Depending on the situation, you might:

• try and negotiate an outcome;

• issue a notice of dispute under the contract;

• try and claim a subcontractor’s charge;

• commence a claim using the security of payment process;

• issue a statutory demand for undisputed debts and subsequently commence a winding up application;

• refer the dispute to arbitration;

• commence Court proceedings; and/or

• write the debt off, and put it down as a lesson learnt.

It will be important to get your strategy right the first time and give yourself the best chance of recovering the rejected construction claim as quickly as possible. You can then again focus on your business.

Below we provide a snapshot of each option.

Pursue commercial negotiation outside the contractual and court framework

This may be the quickest and simplest way for you to resolve your dispute, particularly if you are in a long term contract and want to avoid severing the commercial relationship with your client.

Here you might meet with a representative from the other party in an attempt to resolve the dispute. If an outcome is reached, you and your client will generally agree in writing to reach a settlement.

Negotiations should be conducted on a ‘without prejudice’ basis so that frank discussions cannot be used against you in later proceedings. In order to ensure this happens, you should confirm with all present at the start of any discussion or correspondence, that the discussions are ‘without prejudice’ and note their agreement to that.

Issue a notice of dispute under contract and use the dispute resolution mechanism in the contract

Most Australian Standard contracts contain an escalating dispute resolution process. For example, under clause 42 of AS4000-1997 you would:

1. Issue a written notice of dispute identifying and providing details of the dispute; then

2. Confer to resolve the dispute or to agree on methods of doings so; and

3. If the dispute has not been resolved within 28 days, refer the dispute to arbitration.

Take steps under relevant legislation to charge monies payable to your client (if any)

In Queensland

You may be able to ‘charge’ the monies owing from your client’s client. You can then seek to enforce that charge with Court proceedings. This option is available under the Subcontractors’ Charges Act 1974.

You cannot proceed under this Act and the SOPA at the same time.

This ‘charging’ legislation allows you to leapfrog up the contractual chain by lodging a notice of claim of charge with a principal within three months of completing the work. The claim must be certified by a qualified person and be supported by a statutory declaration.

The charge will stop the principal from making payments to the contractor and that money will secure payment of your claim against the contractor.

To avoid your charge being extinguished, you must commence Court proceedings within one month of giving the notice of claim of charge, or if the claim is in respect of retention money only, within four months after the retention is payable.

A similar mechanism is available in New South Wales under the Contractors Debts Act 1997.

In NSW

You must first obtain judgment against your client and be issued a debt certificate by the Court in respect of the debt.

You must then serve a notice of claim on the principal together with a copy of the debt certificate. The notice of claim must be made within 12 months after the debt becomes payable.

The notice of claim operates as an assignment of the principal’s obligation to pay the money owed to the defaulting contractor. That is, after the notice of claim is served on the principal, the principal must pay the money owed to the defaulting contractor directly to you.

The payments will be made until the principal receives a discharge notice indicating that the certified debt has been fully discharged, or until the payments are no longer payable.

Commence a claim using a legislated security for payment process

You can use the relevant security for payment (SOPA) process as per the legislation in your state. Generally, if you have been engaged under a contract to carry out construction work or to supply related goods and services (as those terms are broadly defined), this process will be available to you.

The process can provide a fast-tracked, interim determination of your claim and significantly help your cash flow.

In the east coast states (i.e. Queensland, New South Wales and Victoria), proceeding under SOPA will most commonly involve the following steps:

1. You submitting a payment claim for the work carried out or related goods and services supplied;

2. Your client responding with a payment schedule;

3. You making an adjudication application;

4. Your client making an adjudication response; and

5. The adjudicator making a decision.

If successful, you may be able to register the decision as a judgment debt and commence enforcement in the same way you would if you won a Court dispute.

The process will generally take between 40 and 70 business days or more, depending on the relevant SOPA legislation.

You must generally have an available reference date under the contract for which you can make your claim.

Each party will bear their own costs, and the adjudicator will apportion their fees depending on the outcome.

You should refer to your State specific SOPA legislation to satisfy yourself of the formal requirements, or seek advice from your construction lawyer.

Issue a statutory demand for undisputed debts and subsequently commence a winding up application

If your client is a corporation, you can serve a statutory demand on a company for an undisputed debt that is due and payable. The debt must be for an amount greater than $2,000.

If it fails to either pay the debt or apply to have the statutory demand set aside, the company is presumed to be insolvent and you can make an application to wind up the company.

The court may set aside the statutory demand if:

1. there is a genuine dispute about the existence or amount of the debt;

2. the company has an offsetting claim against you;

3. there is a defect in the statutory demand which will cause substantial injustice if not set aside; or

4. there is some other reason.

Be cautious – you could be liable for a significant costs order if the statutory demand is set aside by the court.

Refer the dispute to arbitration under the contract

Arbitration may be the last step in the dispute resolution process in your contract. The parties will typically present their arguments and evidence in a similar way to Court proceedings.

The arbitrator will then provide the determination, or ‘award’, at a formal hearing. The award may be final and binding if agreed to by the parties in the contract.

Commence court proceedings seeking final determination

An adjudicator’s decision is only interim. You may instead choose to seek a final determination of your claim in the Magistrates, District or Supreme Court (the appropriate court depending on the value of the claim).

This will usually involve exchanging pleadings (e.g. a statement of claim, defence, reply and counterclaim and defence), disclosure of key documents, evidence from expert witnesses and proceeding to trial.

Costs are commonly awarded in favour of the successful party. Only rarely will all of your actual costs incurred be recoverable.

Write the debt off, and put it down as a lesson learnt

Don’t view a past problem as the end of the world – particularly where it’s not fatal to your business practice.

You can apply lessons learnt to new projects which will see you avoid past problems and stop the reoccurrence of the same issues.

Many of the more aggressive options above can have such a significant opportunity cost with time and attention away from your business. So much so that the smarter commercial decision is to just “get back to work”.

This is not just in terms of choosing the right avenue to pursue your claim. You will be able to recognise common pitfalls that arise during a construction project and implement your lessons learnt to reduce project cost blowouts and liability exposure.

Which claim recovery option should I use?

There are clear advantages and disadvantages with each of the above options.

Some of the factors which may help you make your decision include:

• Whether your claim meets the preconditions of the SOPA legislation;

• Whether there is a genuine dispute about the monies owed;

• Whether the client who owes you the money is insolvent or close to insolvent;

• Whether your client is owed money by their client up the contractual chain;

• Whether you want to resolve the dispute, but maintain a commercial relationship with your client;

• The amount of security (bank guarantees and retention) held by the other side;

• Whether you think the other side is transferring the available funds and assets out of the company;

• The location of the construction works (including here or overseas); and

• The law applicable to the contract.

There may be many more factors that you need to take into account. But make sure you consider each factor and make your decision wisely.

What about you? Have you had a construction claim rejected? What recovery options did you implement? Did you take any additional steps not listed above or the other articles in this series? We welcome your comments.